MiamiHerald.com | 11/24/2006 | No quick healing for victims of birthday party shooting:

Posted on Fri, Nov. 24, 2006 CRIME

No quick healing for victims of birthday party shootingThe family wounded in a shooting at a birthday party last month still grapples with physical and emotional wounds.

BY DAVID OVALLE

dovalle@MiamiHerald.com

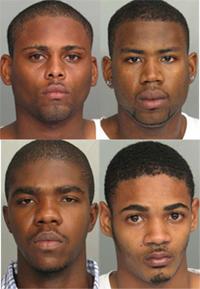

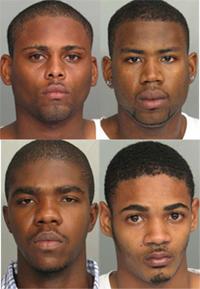

The suspects

CRIME

No quick healing for victims of birthday party shootingThe family wounded in a shooting at a birthday party last month still grapples with physical and emotional wounds.

BY DAVID OVALLE

dovalle@MiamiHerald.com

The suspects

The suspected killers are jailed. The healing has just begun.

That October afternoon, the man who shot Ann Maynard, 31, at point-blank range before a child's birthday party left her with a mangled jaw and a broken arm.

Her sister, Shentara Maynard, 25, still needs surgery to remove a bullet lodged near her spine.

As for Shentara's two little ones, they still haven't grasped the severity of their own wounds.

Here at Jackson Memorial Hospital, Shanterria Kearse, 7, eases her embarrassment by unstrapping her helmet. She wears it to protect the portion of her missing skull.

And Tony Chester, 4, wears thick bandages wrapped around his head, his gait a bit woozy.

''Wiggle, wiggle! Chicken noodle! Chicken noodle!'' He dances a jig for his family.

For now, his spirit is undrained even though his right eye is gone forever.

All four victims still have bullets embedded in their bodies. The physical healing is slow; recovering from the emotional wounds is even slower.

To be sure, there is joy. Tony, his family figures, should have died. The would-be killer fired through the top of his head. The bullet lodged in his eye socket.

''That's modern medicine -- and prayers,'' said his grandmother, Annette Maynard.

And raw guilt: Their cousin, Carla Queely, and her son, Chaquone, 7, didn't survive the bullets.

In a year stained by the callous shootings of young people, names like Zykarious Cadillon, Sherdavia Jenkins and Otissha Burnett have been immortalized by the media, politicians and community leaders.

Yet, these were singular victims. Easy to rally around in marches and protests. Young victims caught in the crossfire of other people's guns.

STUNNED SILENCE

But the Birthday Party Shooting, as many call it, elicited no vigils or public outcry.

Were the facts of the case too jumbled at first? The public too jaded?

Or perhaps the crime was just too ruthless to grasp:

Five gunmen staged a home-invasion robbery, searching for a safe that did not exist. For the family, the surreal images flash back in spurts: Ann hearing a knock on the door, not seeing anyone in the video surveillance monitor; the gunmen bursting in, armed with flex cuffs stuffed in a belt under their shirts; Chaquone suffering from a cold that day.

'My chil' is sick, my chil' is sick,'' Carla sobbed in her thick island accent as the men kept them hostage. ``I just want to have a party. I just want to have a party.''

''If you cry, I'll kill you. I have no problem killing you,'' Ann remembers one of the gunman snarling.

Queely, Chaquone and Ann had been hostage for some 10 minutes when Shentara, Tony and Shanterria entered the home at 20517 NE Ninth Pl., in North Miami-Dade.

Ann, who police say was held at the door by gunman Jose Estache, pushed him away, yelling for them to run. Estache then shot Ann, Shentara and her two children in the head with a .22 caliber pistol.

Police say Sean N. Condell shot Carla and Chaquone; they did not survive. Condell told police he killed them so they couldn't identify him.

''We try to block it out as much as we can,'' Shentara said.

The youngest victim was Tony, a steadily improving Pee Wee football linebacker with an appetite for Vienna sausages and oatmeal.

His family says he is a remarkably spiritual boy. He spits on his hand and blesses his auntie's forehead as if he possessed holy water. He watches sermons on TV and says he wants to be a preacher one day.

Early on, chances seemed slim he would survive. Doctors sedated him for 13 days. Hooked up to life-saving equipment, his swollen body looked more machine than human.

Shentara, his mother, was wracked with guilt. She and her sister had been out of their hospital beds the next day.

Both women struggle with the ''What ifs.'' What if they had done something different that day? What if Ann had looked out the window before opening the door? What if Shentara hadn't played dead once she was wounded?

Why did they survive?

''It was a lot of praying and crying to God. I prayed. I asked God to give him back to me,'' Shentara said of her son.

Then, signs appeared, seemingly every seventh day. He drew breaths on his own. He wiggled his toes. He squeezed his aunt's finger.

Every sign of progress was measured. Emotions ebbed and flowed. His body still shivered; he still drooled.

Hope escalated. Tony opened his eyes. Hope swelled. His mother showed him Sunday newspaper ads. ''Which one is the boy? Which one is the girl?'' she asked.

He pointed correctly. She asked him to point out his favorite sport. Tony lifted his finger to a football someone had brought to the room.

''That's when I knew I had him,'' Shentara recalled.

The family's spirits were buoyed by flowers, balloons and the oversize card signed by Tony's football teammates.

Miami-Dade homicide detectives visited every day. Lead detective Juan Capote brought Tony a red Power Ranger doll.

For the detectives, solving the shooting was urgent -- even if it didn't elicit a huge public outcry. Three teams of detectives were assigned to the case. Many of the detectives have children. Capote himself is the father of a 4-year-old boy.

PAINFUL RECOVERY

As they tracked the five men believed responsible, the victims continued to recover. Doctors removed a portion of the left side of Shanterria's skull. She spent two weeks in bed. She feels self-conscious when she wears her helmet in public. Shanterria understands she was shot -- she cries during therapy, is afraid to go to the bathroom by herself and often wets her bed.

Her aunt, Ann, is still jumpy when she is alone. She was shot through the left side of the cheek; doctors performed surgery after she developed lockjaw.

She was also wounded in both arms: She has no feeling in parts of her left hand; her right arm is broken.

Nothing will bring Carla and Chaquone back. But life trudges on.

The family hopes prosecutors seek the death penalty for the shooters. Perhaps legislation can be passed to toughen crimes against children.

Ann hopes to write a book about her life and the shooting, to inspire teenage girls. She'll call it Which Way Out.

Before the shooting, Shentara wanted to open a group home for disabled people. Now she plans to open one for troubled teenage girls.

On Monday this week, the family received a welcome gift. Tony was discharged earlier than expected. He was home for Thanksgiving.

''It's wonderful. His birthday is next Wednesday,'' Shentara said.

Friday, November 24, 2006

Friday, November 17, 2006

The Ron Brown Scholar Program

My son is a freshman but I have begun the search for scholarship opportunities for college.

The Ron Brown Scholar Program

The Ron Brown Scholar Program seeks to identify African-American high school seniors who will make significant contributions to society. Applicants must excel academically, exhibit exceptional leadership potential, participate in community service activities and demonstrate financial need. The applicant must be a US citizen or hold a permanent resident visa card. Current college students are not eligible to apply.

Each year, a minimum of ten students will be designated Ron Brown Scholars and will receive $10,000 annually for four years, for a total of $40,000. The recipients may use the renewable scholarships to attend an accredited four-year college or university of their choice within the United States. Ron Brown Scholarships are not limited to any specific field or career objective and may be used to pursue any academic discipline. More than 200 students have been designated as Ron Brown Scholars since the inception of the Program.

Ron Brown Scholars are selected in the spring prior to entering college. Applications are screened during the month of February by Ron Brown Scholar Program staff. In March, finalists are invited to participate in a weekend selection process in Washington, D.C. at the expense of the CAP Charitable Foundation. Finalists are interviewed by members of the Ron Brown Selection Committee and are expected to participate in several Selection Weekend activities. Scholarship winners are selected on the basis of their applications, interviews and participation in Selection Weekend activities. Notification follows immediately.

Application Deadline

The Ron Brown Scholar Program currently has two deadlines for applications (students must be current high school seniors at the time of their application):

November 1st - application will be considered for the Ron Brown Scholar Program AND forwarded to a select and limited number of additional scholarship providers.

January 9th - final postmarked deadline in order to be considered for only the Ron Brown Scholar Program ONLY.

Application materials must be mailed in one packet. Transcripts and letters of recommendation should not be sent under separate cover. Incomplete, e-mailed or faxed applications will not be considered.

Due to the volume of applications received, the Ron Brown Scholar Program can only notify semi-finalists and finalists of their status in the competition. This notification will be made in March. Winners of the scholarship will be notified by April 1st and names

The Ron Brown Scholar Program

The Ron Brown Scholar Program seeks to identify African-American high school seniors who will make significant contributions to society. Applicants must excel academically, exhibit exceptional leadership potential, participate in community service activities and demonstrate financial need. The applicant must be a US citizen or hold a permanent resident visa card. Current college students are not eligible to apply.

Each year, a minimum of ten students will be designated Ron Brown Scholars and will receive $10,000 annually for four years, for a total of $40,000. The recipients may use the renewable scholarships to attend an accredited four-year college or university of their choice within the United States. Ron Brown Scholarships are not limited to any specific field or career objective and may be used to pursue any academic discipline. More than 200 students have been designated as Ron Brown Scholars since the inception of the Program.

Ron Brown Scholars are selected in the spring prior to entering college. Applications are screened during the month of February by Ron Brown Scholar Program staff. In March, finalists are invited to participate in a weekend selection process in Washington, D.C. at the expense of the CAP Charitable Foundation. Finalists are interviewed by members of the Ron Brown Selection Committee and are expected to participate in several Selection Weekend activities. Scholarship winners are selected on the basis of their applications, interviews and participation in Selection Weekend activities. Notification follows immediately.

Application Deadline

The Ron Brown Scholar Program currently has two deadlines for applications (students must be current high school seniors at the time of their application):

November 1st - application will be considered for the Ron Brown Scholar Program AND forwarded to a select and limited number of additional scholarship providers.

January 9th - final postmarked deadline in order to be considered for only the Ron Brown Scholar Program ONLY.

Application materials must be mailed in one packet. Transcripts and letters of recommendation should not be sent under separate cover. Incomplete, e-mailed or faxed applications will not be considered.

Due to the volume of applications received, the Ron Brown Scholar Program can only notify semi-finalists and finalists of their status in the competition. This notification will be made in March. Winners of the scholarship will be notified by April 1st and names

Monday, November 13, 2006

Wet Me - Krosfyah - Soca Video

Wet Me - Krosfyah - Soca Video

One of my favorite soca bands. Now if only I could get a video of Pump Me up, my #1 soca song. This will have to do till then. It's a nice groovy soca tune.

Here it is!!! Pump Me Up Video by Krosfyah. I absolutely love this song! I'll dance to this tune anytime.

One of my favorite soca bands. Now if only I could get a video of Pump Me up, my #1 soca song. This will have to do till then. It's a nice groovy soca tune.

Here it is!!! Pump Me Up Video by Krosfyah. I absolutely love this song! I'll dance to this tune anytime.

Saturday, November 11, 2006

Destra Garcia "Max it Up" Soca Video

Destra Garcia "Max it Up" Soca Video - Google Video

I like the high energy in this video... steelpan, carnival and brass. Pure niceness!

I like the high energy in this video... steelpan, carnival and brass. Pure niceness!

U.S. Marshals Make Final Arrest In Birthday Shootings - News - Local10.com | WPLG

Further proof that God answers prayers!

U.S. Marshals Make Final Arrest In Birthday Shootings - News - Local10.com | WPLG

U.S. Marshals Make Final Arrest In Birthday Shootings

5 Men Are Charged In Woman's, Son's Deaths

POSTED: 5:06 pm EST November 10, 2006

MIAMI -- On Friday, U.S. Marshals made the fifth and final arrest in connection with the shooting deaths of a mother and her 7-year-old son who were killed during the boy's birthday party.

Marshals arrested 26-year-old Jose Estache. He was taken into custody at 1943 S.W. 70th Way in North Lauderdale Friday afternoon.

On Thursday, police arrested Rayon Mathew Samuels, Sean Condell, Damian Lewis and Rashid Lee in connection with the Oct. 14 shooting. The men were connected to the shooting by weapons found during the search of a home at 1515 N.W. Third St. in Fort Lauderdale.

Carla Queeley, 34, and her son, Chaquone Watson, died from several gunshot wounds in a north Miami-Dade County neighborhood.

Shantaria Kearse, 7, and sisters Ann Maynard, 31, and Shantara Maynard, 24, were critically injured in the shooting but have since been released from the hospital. Shantaria suffered a serious brain injury when a bullet hit her in the head. Tony Chester, 4, lost an eye because of his injury. He is still hospitalized.

Relatives said that they suspected that the motive for the shooting was robbery.

"This was a brutal act, " said Curtis Maynard, who said he was Queeley's cousin. "They were trying to rob the house. Maybe they didn't expect that there was a birthday party."

Queeley, who was a nurse, was finishing up decorating the house for the birthday party when the armed men forced their way into the back of the home on Northeast Ninth Place, police said.

Police said that Queeley and her son were held hostage briefly while she was forced to call her cousins, who own the home, to tell them to return to the house. Shortly after other family members arrived, the men started shooting, police said.

U.S. Marshals Make Final Arrest In Birthday Shootings - News - Local10.com | WPLG

U.S. Marshals Make Final Arrest In Birthday Shootings

5 Men Are Charged In Woman's, Son's Deaths

POSTED: 5:06 pm EST November 10, 2006

MIAMI -- On Friday, U.S. Marshals made the fifth and final arrest in connection with the shooting deaths of a mother and her 7-year-old son who were killed during the boy's birthday party.

Marshals arrested 26-year-old Jose Estache. He was taken into custody at 1943 S.W. 70th Way in North Lauderdale Friday afternoon.

On Thursday, police arrested Rayon Mathew Samuels, Sean Condell, Damian Lewis and Rashid Lee in connection with the Oct. 14 shooting. The men were connected to the shooting by weapons found during the search of a home at 1515 N.W. Third St. in Fort Lauderdale.

Carla Queeley, 34, and her son, Chaquone Watson, died from several gunshot wounds in a north Miami-Dade County neighborhood.

Shantaria Kearse, 7, and sisters Ann Maynard, 31, and Shantara Maynard, 24, were critically injured in the shooting but have since been released from the hospital. Shantaria suffered a serious brain injury when a bullet hit her in the head. Tony Chester, 4, lost an eye because of his injury. He is still hospitalized.

Relatives said that they suspected that the motive for the shooting was robbery.

"This was a brutal act, " said Curtis Maynard, who said he was Queeley's cousin. "They were trying to rob the house. Maybe they didn't expect that there was a birthday party."

Queeley, who was a nurse, was finishing up decorating the house for the birthday party when the armed men forced their way into the back of the home on Northeast Ninth Place, police said.

Police said that Queeley and her son were held hostage briefly while she was forced to call her cousins, who own the home, to tell them to return to the house. Shortly after other family members arrived, the men started shooting, police said.

Friday, November 10, 2006

cbs4.com - Arrests Made In Birthday Party Murders

Proof that God truly answers prayers.

cbs4.com - Arrests Made In Birthday Party Murders: "Arrests Made In Birthday Party Murders

One Suspect Remains On The Loose

Carey Codd

Reporting

(CBS4) FT. LAUDERDALE Police have made four arrests in the murder of a North Miami-Dade mother and the shooting of her 7-year old son at the boy’s Spider-Man themed birthday party last month.

The arrests were made Wednesday after detectives raided a Fort Lauderdale apartment in the 1500 block of Northwest Third Street. Police also seized a cache of weapons and other items from the home. There were shotguns, Tec 9’s, rifles and even bullet proof vests discovered in the home.

One arrest was made after the raid and it didn’t take long before police linked the weapons discovery to the birthday party murders.

Sean Condell, aka “Shorty”, who police say confessed to the crime was arrested. Condell and Rayon Samuels, 20, have been charged with two counts of first-degree murder as well as other counts of attempted murder. Bjon Rashid Lewis, 27, and Damian Lewis, 23, were also jailed Thursday in connection to the crime.

Teams of homicide detectives have been working to solve the Oct. 14 shootings of Carla Queeley, 34, and her son, Shaquon Watson.

According to the Arrest Affidavit of Condell, he and another suspect, identified as Jose Estache entered the home at 20517 NE 9th Place, in order to commit a home invasion armed robbery.

The affidavit states that the men were armed with three guns, plastic flex cuffs and gloves when they entered the home.

Once inside, the suspects demanded to know where the safe was, while holding three of the victims at gunpoint, including Queeley, a nurse, who was preparing decorations for her son’s birthday party.

Three other victims arrived at the house in the middle of the robbery. Estache, allegedly took one victim to the front door at gunpoint. When the victim opened the front door, she told her sister and her sister’s two children, 7-year old Shantaria Kearse and 4-year old Tony Chester, to run.

When they did, the affidavit claims Estache fired his .22 caliber gun at the women and the two children. All four victims were shot in the head and sustained critical injuries. They’ve since been released from the hospital with the bullets still in their heads.

4-year old Tony Chester has lost an eye and 7-year old Shantaria Kearse will need brain surgery.

Queeley’s brother, Livingston Queeley spoke to CBS4’S Carey Codd and when told of Thursday’s arrests replied, “He deserved just what he done to my sister and nephew. He needs to get the worst punishment for this crime.”

The affidavit states police have a videotaped confession from Condell stating he shot Queeley and her son so they would not identify him in the crime.

(© MMVI, CBS Broadcasting Inc. All Rights Reserved.)

cbs4.com - Arrests Made In Birthday Party Murders: "Arrests Made In Birthday Party Murders

One Suspect Remains On The Loose

Carey Codd

Reporting

(CBS4) FT. LAUDERDALE Police have made four arrests in the murder of a North Miami-Dade mother and the shooting of her 7-year old son at the boy’s Spider-Man themed birthday party last month.

The arrests were made Wednesday after detectives raided a Fort Lauderdale apartment in the 1500 block of Northwest Third Street. Police also seized a cache of weapons and other items from the home. There were shotguns, Tec 9’s, rifles and even bullet proof vests discovered in the home.

One arrest was made after the raid and it didn’t take long before police linked the weapons discovery to the birthday party murders.

Sean Condell, aka “Shorty”, who police say confessed to the crime was arrested. Condell and Rayon Samuels, 20, have been charged with two counts of first-degree murder as well as other counts of attempted murder. Bjon Rashid Lewis, 27, and Damian Lewis, 23, were also jailed Thursday in connection to the crime.

Teams of homicide detectives have been working to solve the Oct. 14 shootings of Carla Queeley, 34, and her son, Shaquon Watson.

According to the Arrest Affidavit of Condell, he and another suspect, identified as Jose Estache entered the home at 20517 NE 9th Place, in order to commit a home invasion armed robbery.

The affidavit states that the men were armed with three guns, plastic flex cuffs and gloves when they entered the home.

Once inside, the suspects demanded to know where the safe was, while holding three of the victims at gunpoint, including Queeley, a nurse, who was preparing decorations for her son’s birthday party.

Three other victims arrived at the house in the middle of the robbery. Estache, allegedly took one victim to the front door at gunpoint. When the victim opened the front door, she told her sister and her sister’s two children, 7-year old Shantaria Kearse and 4-year old Tony Chester, to run.

When they did, the affidavit claims Estache fired his .22 caliber gun at the women and the two children. All four victims were shot in the head and sustained critical injuries. They’ve since been released from the hospital with the bullets still in their heads.

4-year old Tony Chester has lost an eye and 7-year old Shantaria Kearse will need brain surgery.

Queeley’s brother, Livingston Queeley spoke to CBS4’S Carey Codd and when told of Thursday’s arrests replied, “He deserved just what he done to my sister and nephew. He needs to get the worst punishment for this crime.”

The affidavit states police have a videotaped confession from Condell stating he shot Queeley and her son so they would not identify him in the crime.

(© MMVI, CBS Broadcasting Inc. All Rights Reserved.)

Monday, November 06, 2006

cbs4.com - Robber Could Have Caused Birthday Boy's Death

Carla was born in St. Kitts but grew up in the Virgin Islands.

Oct 16, 2006 7:57 pm US/Eastern

cbs4.com - Robber Could Have Caused Birthday Boy's Death

Relatives believe robbery may be the motive

Carla Queeley And Her Son Were Killed

Carey Codd

Reporting

(CBS4 News) NORTHEAST MIAMI-DADE Two victims, hurt in Saturday’s brutal murder of a young mother and her son at a birthday party in North Miami-Dade, have been released from the hospital, all while a community and police try to figure out why the crime occurred in the first place.

Sisters Ann Maynard, 31, a Miami-Dade Corrections Department nurse and Shantara Maynard, 24, a bartender, were released Monday morning. Shantara’s 7-year-old daughter, Shantaria Kearse and 4-year-old son, Tony Chester, remain hospitalized at Jackson Memorial Hospital. They are the survivors of Saturday’s shooting which grieving family members speculate might have been motivated by robbery.

Carla Queeley, 34, a nurse was killed along with her son, Shaquon Watson, who was celebrating his 7th birthday with a Spiderman theme party. Monday, grief counselors were out at the boy's school, Lakeview Elementary, to provide emotional needed help for grieving students.

The school principal says the loss was felt by many at the school.

"It's devastating when you hear that one of your students, who you deal with on a day-in, day-out, has gone through such a catastrophe," said Principal Jeffrey Hernandez.

Relatives say that only minutes after breaking in to the home located at 20517 NE 9 Place, the gunmen demanded Queeley, who was decorating the home for her son’s birthday party, to call the owners of the house so she could show them where the money was kept. Gunfire broke out soon afterward, they said.

It's unclear whether money or valuables were taken.

Party guests arrived after 3 p.m. to find the home surrounded by yellow police tape.

Official information about the Saturday afternoon assault has been hard to come by; police made no statements Sunday and had little to say after the attack. They also have not released any type of description of the suspects. Detectives describe the case as an "ongoing, sensitive criminal investigation."

Sandry Bowers lives across the street from the home where the attack took place, and said she heard a knock at the door Saturday When she opened it, she found Ann Maynard drenched in blood.

“And the blood came in, and then she said, ‘Hurry, he’s coming’” she recalled. “And I just closed it back because, I mean, if somebody’s going to come he could come in here as well and shoot me and my grand-daughter too.”

Bowers said Maynard owns the home, and was hosting the birthday party. She was told by a relative what apparently happened in the home.

“She said they just walked up and shot the little boy in the head, and they were just walking around and shooting everybody, just shooting them with no reason,” Bowers said. “That’s what she said.”

Residents of the neighborhood say they have no idea why the home was targeted, and are upset they have heard nothing from police investigating the attack.

"It's sad, you know, because they are so innocent and wholesome and were shot and killed," said Livingston Queeley, whose sister died in the attack.

"It's devious," said Dehana. "They don't have anything else to do but go out and kill a 7 year old child and an innocent lady? She's not doing nobody nothing."

Family members have started planning funeral arrangements for the dead, even as they anxiously watch over those being treated for gunshot wounds.

The person or people responsible for the attack remain at large.

Anyone with information can call Miami-Dade Crime Stoppers at 305-471-8477.

(© MMVI, CBS Broadcasting Inc. All Rights Reserved.)

Oct 16, 2006 7:57 pm US/Eastern

cbs4.com - Robber Could Have Caused Birthday Boy's Death

Relatives believe robbery may be the motive

Carla Queeley And Her Son Were Killed

Carey Codd

Reporting

(CBS4 News) NORTHEAST MIAMI-DADE Two victims, hurt in Saturday’s brutal murder of a young mother and her son at a birthday party in North Miami-Dade, have been released from the hospital, all while a community and police try to figure out why the crime occurred in the first place.

Sisters Ann Maynard, 31, a Miami-Dade Corrections Department nurse and Shantara Maynard, 24, a bartender, were released Monday morning. Shantara’s 7-year-old daughter, Shantaria Kearse and 4-year-old son, Tony Chester, remain hospitalized at Jackson Memorial Hospital. They are the survivors of Saturday’s shooting which grieving family members speculate might have been motivated by robbery.

Carla Queeley, 34, a nurse was killed along with her son, Shaquon Watson, who was celebrating his 7th birthday with a Spiderman theme party. Monday, grief counselors were out at the boy's school, Lakeview Elementary, to provide emotional needed help for grieving students.

The school principal says the loss was felt by many at the school.

"It's devastating when you hear that one of your students, who you deal with on a day-in, day-out, has gone through such a catastrophe," said Principal Jeffrey Hernandez.

Relatives say that only minutes after breaking in to the home located at 20517 NE 9 Place, the gunmen demanded Queeley, who was decorating the home for her son’s birthday party, to call the owners of the house so she could show them where the money was kept. Gunfire broke out soon afterward, they said.

It's unclear whether money or valuables were taken.

Party guests arrived after 3 p.m. to find the home surrounded by yellow police tape.

Official information about the Saturday afternoon assault has been hard to come by; police made no statements Sunday and had little to say after the attack. They also have not released any type of description of the suspects. Detectives describe the case as an "ongoing, sensitive criminal investigation."

Sandry Bowers lives across the street from the home where the attack took place, and said she heard a knock at the door Saturday When she opened it, she found Ann Maynard drenched in blood.

“And the blood came in, and then she said, ‘Hurry, he’s coming’” she recalled. “And I just closed it back because, I mean, if somebody’s going to come he could come in here as well and shoot me and my grand-daughter too.”

Bowers said Maynard owns the home, and was hosting the birthday party. She was told by a relative what apparently happened in the home.

“She said they just walked up and shot the little boy in the head, and they were just walking around and shooting everybody, just shooting them with no reason,” Bowers said. “That’s what she said.”

Residents of the neighborhood say they have no idea why the home was targeted, and are upset they have heard nothing from police investigating the attack.

"It's sad, you know, because they are so innocent and wholesome and were shot and killed," said Livingston Queeley, whose sister died in the attack.

"It's devious," said Dehana. "They don't have anything else to do but go out and kill a 7 year old child and an innocent lady? She's not doing nobody nothing."

Family members have started planning funeral arrangements for the dead, even as they anxiously watch over those being treated for gunshot wounds.

The person or people responsible for the attack remain at large.

Anyone with information can call Miami-Dade Crime Stoppers at 305-471-8477.

(© MMVI, CBS Broadcasting Inc. All Rights Reserved.)

Friday, July 14, 2006

SUNPHONIX STEEL ORCHESTRA'S TRIBUTE TO Winston "MoutaBee" Phillips

SUNPHONIX

STEEL ORCHESTRA'S

TRIBUTE TO

Winston "MoutaBee" Phillips

1942-2006

“Pan Pioneer”

MoutaBee, also called "Bee" was a stalwart who dedicated his life to the advancement and recognition of the steelband movement. He played pan all over the world. An original Invaders member, he arranged for many steelbands in Trinidad, London, Germany, Canada, New York, California, Washington, Miami and a long list of others too many to detail.

In Miami, starting with North Side Steelband, he moved to New Image Steelband and then on to Sunphonix Steel Orchestra. From the old days of "Softly in the Morning Sunrise" to his latest arrangement of "How Great Thou Art", members would forever remember his dedication to "get it right" (his favorite expression).

Now that he has been lifted up to the stars, please join us as we honor his memory.

SATURDAY JULY 15TH 2006

6:00 PM UNTIL

THE SUNPHONIX PANYARD

2734 NW 183RD STREET

MIAMI GARDENS

CALL: (305) 622-7255

INVITED GUESTS: Hon. Gerard Greene (T&T Consul General), Harvey R. Borris (Consul Info.), Carl and Carol Jacobs, Reporter, Dry River, Picoplat, Marlon Sirju (SoJoe); Andrew Romero (New Musical Arranger for Sunphonix), Rising Star Steel Orchestra, Uprising Steel Orchestra, Lauderhill Steel Ensemble, Miami Pan Symphony; DJ Tee Rexx, DJ Guru, DJ Roderick, as well as a Major Surprise ! !

FOOD & REFRESHMENTS AVAILABLE

STEEL ORCHESTRA'S

TRIBUTE TO

Winston "MoutaBee" Phillips

1942-2006

“Pan Pioneer”

MoutaBee, also called "Bee" was a stalwart who dedicated his life to the advancement and recognition of the steelband movement. He played pan all over the world. An original Invaders member, he arranged for many steelbands in Trinidad, London, Germany, Canada, New York, California, Washington, Miami and a long list of others too many to detail.

In Miami, starting with North Side Steelband, he moved to New Image Steelband and then on to Sunphonix Steel Orchestra. From the old days of "Softly in the Morning Sunrise" to his latest arrangement of "How Great Thou Art", members would forever remember his dedication to "get it right" (his favorite expression).

Now that he has been lifted up to the stars, please join us as we honor his memory.

SATURDAY JULY 15TH 2006

6:00 PM UNTIL

THE SUNPHONIX PANYARD

2734 NW 183RD STREET

MIAMI GARDENS

CALL: (305) 622-7255

INVITED GUESTS: Hon. Gerard Greene (T&T Consul General), Harvey R. Borris (Consul Info.), Carl and Carol Jacobs, Reporter, Dry River, Picoplat, Marlon Sirju (SoJoe); Andrew Romero (New Musical Arranger for Sunphonix), Rising Star Steel Orchestra, Uprising Steel Orchestra, Lauderhill Steel Ensemble, Miami Pan Symphony; DJ Tee Rexx, DJ Guru, DJ Roderick, as well as a Major Surprise ! !

FOOD & REFRESHMENTS AVAILABLE

Tuesday, June 13, 2006

5 tips for wisely tapping your home equity

5 tips for wisely tapping your home equity

Bankers love it when you borrow against your house. That's reason enough to be wary of home-equity lending.

Yet millions of Americans are buying lenders' pitches that our homes are a good source of funds for whatever our little hearts desire, from Super Bowl tickets to exotic vacations to investments in stocks and bonds. That lust for cheap cash has turned home-equity lending into the fastest-growing, and very profitable, area of consumer loans.

Mainstream home-equity lending soared 33% last year according to SMR Research, with new borrowing at nearly quadruple the level of just five years ago. The amount we owe on home-equity loans and lines of credit, $719 billion, now exceeds the balances on our Visas, MasterCards and other general-purpose credit cards.

Home-equity lending skyrockets

2004 1999 Increase

New borrowing $431 billion $114 billion 278%

Total owed $719 billion $267 billion 169%

Source: SMR Research

Those figures don't include home-equity lending to people with troubled credit. So-called subprime mortgage lending rose 60% last year, said SMR vice president George Yacik, to $516 billion. Although the figure includes first mortgages, Yacik said most subprime home lending involves home-equity loans and lines of credit.

Good for banks, risky for consumers

The risk to lenders from all this debt is quite low. The amount banks actually lose on home-equity lending overall is about 0.15%, Yacik said, compared to more than 3% on credit cards.

"There's no bad debt to speak of," Yacik said. "(The borrower's) home is at stake, and they have to be deeply extended not to pay their bill."

Rising home prices mean that banks can get their money back even if they have to foreclose, and troubled borrowers typically sell the home or refinance before that happens.

The low default rate masks the real problem with home-equity lending: Most borrowers are using the loans and lines of credit to fritter away their long-term wealth on short-term spending.

"I recall one computer magazine a couple of years ago that recommended that people get home-equity loans or lines of credit to purchase computers," said Andrew Analore, editor of Inside B&C Lending, an Inside Mortgage Finance publication. Then there was the recent Associated Press article about fans calling mortgage lenders to finance Super Bowl tickets, on top of the more usual borrowing to fund big-screen TVs to watch the game.

"That kind of stuff can be problematic," Analore said, "because people sometimes don't understand that their house is on the line if, for some reason, they are unable to pay for their new computer or big-screen television."

Understand loan types

Solid statistics are hard to find, but lenders believe a third or less of home-equity borrowing is used for anything that could be considered an investment, such as home improvements or education. The rest goes for debt consolidation, vacations or purchases of assets that quickly depreciate, such as cars.

If you're thinking of literally betting your house with a home-equity loan or line of credit, you should clearly understand how these loans work, when to use them and how to get the best deals.

First, the basics. There are two types of home equity lending, loans and lines of credit:

Home-equity loans are installment loans, like regular mortgages and auto loans. You're given a certain amount of money which you typically receive all at once and pay back according to a set schedule, over time. Home-equity loans usually come with fixed rates and fixed payments.

Home-equity lines of credit, by contrast, work more like credit cards. You're given a credit limit that you can borrow against, and paying down your debt frees up more credit that you can potentially spend. Home-equity lines of credit have variable interest rates that are typically tied to the prime rate.

Unlike credit cards, however, home-equity lines of credit usually aren't open-ended. For the first 10 years or so, you can draw as much as you want from your credit limit, and you only need to pay the interest charges. In the next stage, however, the "draw" period ends and whatever debt you have left is "amortized," which means you need to start paying principal and interest to retire your debt. (Some lenders let you renew your draw period, but eventually the debt has to be paid off.)

Average amounts borrowed

Types

2004

1999

Increase

Lines of credit

$77,526

$49,260

57%

Loans

$62,112

$35,672

74%

Source: Consumer Bankers Association

With either type of borrowing, you're pledging your home as collateral. If you fall behind on your payments, the lender can foreclose and take your house.

When to use these loans

A home-equity loan is generally the best choice when you know exactly how much your purchase is likely to cost and you need several years to pay it off. A major home-improvement project, for example, might be a good candidate for a home-equity loan.

A line of credit may be a better option for shorter-term borrowing, or when you want to be able to tap your home equity to cover emergencies.

You also might consider a loan, rather than a line of credit, when you want to lock in a low interest rate in a rising-rate environment, like we have now. In recent months, the rates on lines of credit have been ratcheting up with each Federal Reserve hike.

The gap has narrowed considerably from a few years ago, when lines of credit averaged more than two percentage points less than loans. When the gap is that big, it may make sense to take the risk of choosing a variable-rate line of credit over a fixed-rate loan.

5 tips for smart borrowing

Here's how to know if you're getting a good deal:

Compare the rates. The rate you'll be offered on a loan or line of credit depends heavily on your credit score -- perhaps too much, according to one banking regulator. Julie Williams, acting head of the U.S. Comptroller of the Currency, said in December that home-equity lenders were relying too much on "risk factor shortcuts" like credit scores, which reflect consumer's past credit performance but that don't factor in how well they'll handle a big increase in their debt.

If you have an excellent score of 760 or above, you should be able to win a home-equity line of credit for half a point below the prime rate, said Chris Larsen, CEO of E-Loan. A good score of 700 to 759 should win you a rate equal to prime. (To see current rates on lines of credit and loans by credit score, visit the Loan Savings Calculator at MyFico.com.) People with mediocre to poor credit can pay 1 to 5 points over prime, or more.

Avoid the fees. If you have decent credit, you shouldn't have to pay any application or appraisal fees to borrow against your home. (Make sure the lender isn't tacking fees onto the loan amount, and that you're not paying a "broker fee" if a third party is helping to arrange the loan.) You may have to pay recording fees, which should be minimal, and an annual fee on your credit line.

Know the tax rules. Home-equity borrowing is often touted as superior to other consumer debt because you can deduct the interest. But that's not always true. You have to be able to itemize, which most taxpayers can't do because they don't have enough deductions.

If you have excellent credit, for example, you might be able to get a new car loan for a fixed rate that's actually lower than what you'd get on a variable line of credit. Unless you're able to itemize, the fixed-rate auto loan is clearly the way to go.

Also, know that even if you do get a deduction, the tax break is limited to interest on loan amounts of $100,000 or less; if you've borrowed more, the interest you pay on amounts over $100,000 can't be deducted.

Know what you're risking. A home can be a good way to build long-term wealth -- as long as you're not constantly draining it away. Every dollar of equity you borrow is a dollar that can't be used to buy your next home when you're ready to trade up, or to fund your retirement when you're ready to downsize.

Be particularly wary of using home equity to pay off credit cards or other short-term debt. Often you'll just wind up deeper in debt because you haven't addressed the basic overspending problem that got you into trouble in the first place.

Also, don't assume that using equity to pay for home improvements or education is always a slam dunk. Not all home improvements add value and it's easy to go overboard with student-loan debt, as well. It's up to you to set reasonable limits on your borrowing and to make sure that what you're buying is worth the wealth you're committing.

In general, you don't want the term of your borrowing to last longer than what you've purchased. If you use home-equity borrowing to buy a car, for example, try to pay off the balance in a few years -- and definitely before you trade in for a new vehicle.

Keep some headroom. You should try to keep a cushion of at least 20% equity in your home. If your combined mortgage and home-equity borrowing exceeds that amount, you'll pay higher interest rates. You're also cutting yourself off from an important source of funds in an emergency.

"Very few families are good at savings. In effect, their home equity is their 'rainy day' fund," Analore said. "It's the only source of capital that many people will be able to tap in an emergency. And it won't be there if the home has already been leveraged to fund short-term consumption."

Liz Pulliam Weston's column appears every Monday and Thursday, exclusively on MSN Money. She also answers reader questions in the Your Money message board.

Bankers love it when you borrow against your house. That's reason enough to be wary of home-equity lending.

Yet millions of Americans are buying lenders' pitches that our homes are a good source of funds for whatever our little hearts desire, from Super Bowl tickets to exotic vacations to investments in stocks and bonds. That lust for cheap cash has turned home-equity lending into the fastest-growing, and very profitable, area of consumer loans.

Mainstream home-equity lending soared 33% last year according to SMR Research, with new borrowing at nearly quadruple the level of just five years ago. The amount we owe on home-equity loans and lines of credit, $719 billion, now exceeds the balances on our Visas, MasterCards and other general-purpose credit cards.

Home-equity lending skyrockets

2004 1999 Increase

New borrowing $431 billion $114 billion 278%

Total owed $719 billion $267 billion 169%

Source: SMR Research

Those figures don't include home-equity lending to people with troubled credit. So-called subprime mortgage lending rose 60% last year, said SMR vice president George Yacik, to $516 billion. Although the figure includes first mortgages, Yacik said most subprime home lending involves home-equity loans and lines of credit.

Good for banks, risky for consumers

The risk to lenders from all this debt is quite low. The amount banks actually lose on home-equity lending overall is about 0.15%, Yacik said, compared to more than 3% on credit cards.

"There's no bad debt to speak of," Yacik said. "(The borrower's) home is at stake, and they have to be deeply extended not to pay their bill."

Rising home prices mean that banks can get their money back even if they have to foreclose, and troubled borrowers typically sell the home or refinance before that happens.

The low default rate masks the real problem with home-equity lending: Most borrowers are using the loans and lines of credit to fritter away their long-term wealth on short-term spending.

"I recall one computer magazine a couple of years ago that recommended that people get home-equity loans or lines of credit to purchase computers," said Andrew Analore, editor of Inside B&C Lending, an Inside Mortgage Finance publication. Then there was the recent Associated Press article about fans calling mortgage lenders to finance Super Bowl tickets, on top of the more usual borrowing to fund big-screen TVs to watch the game.

"That kind of stuff can be problematic," Analore said, "because people sometimes don't understand that their house is on the line if, for some reason, they are unable to pay for their new computer or big-screen television."

Understand loan types

Solid statistics are hard to find, but lenders believe a third or less of home-equity borrowing is used for anything that could be considered an investment, such as home improvements or education. The rest goes for debt consolidation, vacations or purchases of assets that quickly depreciate, such as cars.

If you're thinking of literally betting your house with a home-equity loan or line of credit, you should clearly understand how these loans work, when to use them and how to get the best deals.

First, the basics. There are two types of home equity lending, loans and lines of credit:

Home-equity loans are installment loans, like regular mortgages and auto loans. You're given a certain amount of money which you typically receive all at once and pay back according to a set schedule, over time. Home-equity loans usually come with fixed rates and fixed payments.

Home-equity lines of credit, by contrast, work more like credit cards. You're given a credit limit that you can borrow against, and paying down your debt frees up more credit that you can potentially spend. Home-equity lines of credit have variable interest rates that are typically tied to the prime rate.

Unlike credit cards, however, home-equity lines of credit usually aren't open-ended. For the first 10 years or so, you can draw as much as you want from your credit limit, and you only need to pay the interest charges. In the next stage, however, the "draw" period ends and whatever debt you have left is "amortized," which means you need to start paying principal and interest to retire your debt. (Some lenders let you renew your draw period, but eventually the debt has to be paid off.)

Average amounts borrowed

Types

2004

1999

Increase

Lines of credit

$77,526

$49,260

57%

Loans

$62,112

$35,672

74%

Source: Consumer Bankers Association

With either type of borrowing, you're pledging your home as collateral. If you fall behind on your payments, the lender can foreclose and take your house.

When to use these loans

A home-equity loan is generally the best choice when you know exactly how much your purchase is likely to cost and you need several years to pay it off. A major home-improvement project, for example, might be a good candidate for a home-equity loan.

A line of credit may be a better option for shorter-term borrowing, or when you want to be able to tap your home equity to cover emergencies.

You also might consider a loan, rather than a line of credit, when you want to lock in a low interest rate in a rising-rate environment, like we have now. In recent months, the rates on lines of credit have been ratcheting up with each Federal Reserve hike.

The gap has narrowed considerably from a few years ago, when lines of credit averaged more than two percentage points less than loans. When the gap is that big, it may make sense to take the risk of choosing a variable-rate line of credit over a fixed-rate loan.

5 tips for smart borrowing

Here's how to know if you're getting a good deal:

Compare the rates. The rate you'll be offered on a loan or line of credit depends heavily on your credit score -- perhaps too much, according to one banking regulator. Julie Williams, acting head of the U.S. Comptroller of the Currency, said in December that home-equity lenders were relying too much on "risk factor shortcuts" like credit scores, which reflect consumer's past credit performance but that don't factor in how well they'll handle a big increase in their debt.

If you have an excellent score of 760 or above, you should be able to win a home-equity line of credit for half a point below the prime rate, said Chris Larsen, CEO of E-Loan. A good score of 700 to 759 should win you a rate equal to prime. (To see current rates on lines of credit and loans by credit score, visit the Loan Savings Calculator at MyFico.com.) People with mediocre to poor credit can pay 1 to 5 points over prime, or more.

Avoid the fees. If you have decent credit, you shouldn't have to pay any application or appraisal fees to borrow against your home. (Make sure the lender isn't tacking fees onto the loan amount, and that you're not paying a "broker fee" if a third party is helping to arrange the loan.) You may have to pay recording fees, which should be minimal, and an annual fee on your credit line.

Know the tax rules. Home-equity borrowing is often touted as superior to other consumer debt because you can deduct the interest. But that's not always true. You have to be able to itemize, which most taxpayers can't do because they don't have enough deductions.

If you have excellent credit, for example, you might be able to get a new car loan for a fixed rate that's actually lower than what you'd get on a variable line of credit. Unless you're able to itemize, the fixed-rate auto loan is clearly the way to go.

Also, know that even if you do get a deduction, the tax break is limited to interest on loan amounts of $100,000 or less; if you've borrowed more, the interest you pay on amounts over $100,000 can't be deducted.

Know what you're risking. A home can be a good way to build long-term wealth -- as long as you're not constantly draining it away. Every dollar of equity you borrow is a dollar that can't be used to buy your next home when you're ready to trade up, or to fund your retirement when you're ready to downsize.

Be particularly wary of using home equity to pay off credit cards or other short-term debt. Often you'll just wind up deeper in debt because you haven't addressed the basic overspending problem that got you into trouble in the first place.

Also, don't assume that using equity to pay for home improvements or education is always a slam dunk. Not all home improvements add value and it's easy to go overboard with student-loan debt, as well. It's up to you to set reasonable limits on your borrowing and to make sure that what you're buying is worth the wealth you're committing.

In general, you don't want the term of your borrowing to last longer than what you've purchased. If you use home-equity borrowing to buy a car, for example, try to pay off the balance in a few years -- and definitely before you trade in for a new vehicle.

Keep some headroom. You should try to keep a cushion of at least 20% equity in your home. If your combined mortgage and home-equity borrowing exceeds that amount, you'll pay higher interest rates. You're also cutting yourself off from an important source of funds in an emergency.

"Very few families are good at savings. In effect, their home equity is their 'rainy day' fund," Analore said. "It's the only source of capital that many people will be able to tap in an emergency. And it won't be there if the home has already been leveraged to fund short-term consumption."

Liz Pulliam Weston's column appears every Monday and Thursday, exclusively on MSN Money. She also answers reader questions in the Your Money message board.

Don't hand your house to a thief

Don't hand your house to a thief

Mortgage scams are like Baskin-Robbins offerings -- they come in 31 flavors. Here are three top choices of con artists and how to avoid them.

By Christopher Solomon

If owning a home is the great American dream, then swindling people out of their prized possession is one of the great, lucrative American scams. Mortgage fraud is on the rise, thanks to the tremendous value that's locked up in real estate today and to the increasing number of people who are struggling to pay their mortgages.

"It's kind of become the new get-rich-quick scheme out there," says attorney Rachel Dollar, publisher of Mortgage Fraud Blog.

More than 323,000 properties entered some state of foreclosure in the first quarter of 2006, a 72% increase over the same period a year ago, according to RealtyTrac. And things could get worse: Nationwide, more than one in three outstanding mortgages has an adjustable rate and interest rates have been rising. "Nobody really knows what's going to happen," says RealtyTrac's Rick Sharga, vice president of marketing.

But scammers know that people in trouble make easy victims. They're swooping in and offering to "help" beleaguered borrowers -- and ending up with their house keys. Victims sometimes spend years fighting to get their homes back and some never succeed.

Meet Carol and Anthony

Carol and Anthony Calvagno of Deer Park, N.Y., on Long Island are in a hell like this right now. In 2003, the Calvagnos were in trouble. Anthony Calvagno had health troubles and had lost his job. In order to pay their bills, the couple took out a home equity loan on the Cape Cod-style house that had been in the family for three generations. (At the time, the couple had a $125,000 mortgage on a house worth about $290,000 -- a high-equity target.) But even the home equity loan wasn't enough.

That's when Mitchell Sims swooped in, offering to help, says the couple's attorney, Arshad Majid.

Sims told the couple that he would arrange a bailout, and that they should stop making mortgage payments while he worked out the details. When foreclosure notices started showing up, he told the couple to ignore them, saying he'd take care of it.

Nearly eight weeks after Sims had entered their lives, and the day before their foreclosure was scheduled, Sims told the Calvagnos that the arrangement hadn't worked. Instead, he said they'd have to file for bankruptcy and enter a "special program" in which they'd sign over their house's title to one of Sims' employees and another of his business associates, who also happened to be Sims' brother. They'd be allowed to live in their home as tenants, Sims told them, and their rent payments would go toward buying their home back from him, says Majid. "They were put in the position where they didn't have any choice" but to sell their deed, Majid says.

But Sims never made any mortgage payments. He kept the Calvagnos' rent money and about $50,000 of the couple's money that remained after their creditors were paid.

The Calvagnos had fallen victim to a scam known as equity stripping -- just one of the many flavors of mortgage fraud. Their house was sold. Sims and another person have been put in prison for their crimes. The couple has successfully fought eviction -- so far -- but not everyone is so lucky. Here's a quick look at three of the main ways scammers can steal the roof over your head.

Scam No. 1: The bailout, aka 'equity stripping'

As the Calvagnos' case shows, this scam is particularly ingenious -- and humiliating for the victim. In theory, a person or company could help a homeowner keep his house via a process in which the homeowner sells the house very cheaply to them while the homeowner gets his finances in order. The new owner pays the mortgage, and the old homeowner pays to live in the home in the meantime, buying back the home (with interest) in a fixed amount of time. If the financial setbacks are temporary, and the company is above-board, everybody can win: The homeowner keeps the house and the company earns a profit for its role as rescuer.

But "reconveyance," as it's sometimes known, is ripe for abuse.

Attorney Leah Weaver, who focuses on fighting the scams as an Equal Justice Works Fellow at the Legal Aid Society of Minneapolis, explains how scammers work this fraud:

Suppose you've got a $200,000 home, with $100,000 of equity in it. A divorce and medical bills have you facing foreclosure. Suddenly, the phone rings with a bailout proposal.

So you sell your home, for $120,000 -- not much more than what's owed on the mortgage. Why sell for so little? "Because it's never intended to be a true sale," Weaver explains; remember, you don't think you're selling the house permanently, but buying it back in a short period, right?

The new purchaser, meanwhile, takes out a $120,000 loan, wipes out any liens on your property and even gets you a little cash back; and you get a two-year lease with a purchase option at the end.

But soon you realize you're in trouble. Why? Because scammers aren't about to let you get your home back. Often, the lease terms desperate homeowners agree to turn out to be as onerous as their previous mortgage payments that helped get them into trouble. Con artists also manipulate victims when facing crucial deadlines.

"One of my clients was told that payments were going be to under $1,000 a month," Weaver recalls. But the criminals dragged out the process until the foreclosure was imminent and she was backed into a corner. "When she got to the closing … they were like, 'Oh, no, the payments are going to be $1,150.'

"Inevitably," she says, "you're going to default."

And default isn't pretty. The new purchaser evicts you as soon as possible, sells your $200,000 house, pays off the $120,000 loan and pockets about $80,000 -- all for a few months' work, says Weaver. Some people don't even fight back because they don't know they have options -- such as calling a lawyer, says attorney Dollar.

Do's and don'ts:

• Don't fall for promises like "We'll save your credit"; "We'll buy your house 'as is'"; or "We'll get you a new mortgage with low monthly payments."

• Don't sign away ownership of your property (sometimes called a "quit claim deed") to anyone without the advice of lawyer you trust. "When people get behind on their loan payments, they get a bit desperate, but the answer is not putting someone else on your title," says Oakland real-estate attorney James Hand.

• Beware of any home sale contract where you aren't formally released from liability for your mortgage. Also, make sure you know what rights you're giving up and that you agree to giving them up.

Scam No. 2: Phantom help

This scheme is fairly simple: Let's say you're way behind on your home payments and facing foreclosure. An individual or group approaches and offers to help -- then charges you thousands of dollars for various administrative duties like filing forms and phone calls, or else keeps simply promising a big rescue later. You can probably guess what's really going on: The "helper" isn't really doing anything at all to stop your foreclosure despite collecting thousands from you. By the time you figure out you've been hoodwinked, it's often too late to stop the loss of your house.

How did the scammer know to target you, anyway? That's easy: When a lender schedules the home for public auction, the matter becomes public record. In just more than half of the states, a lawsuit must be filed in order to spur a sale. Anyone can check the court documents to find the list of lawsuits, says Elizabeth Renuart, an attorney with the National Consumer Law Center and co-author of a major report last year on mortgage fraud called "Dreams Foreclosed." Soon, a letter or phone call comes like something from a guardian angel -- only it's a vulture.

In the other states (including California and Massachusetts, for example), the process doesn't go through the courts; foreclosure sales simply must be advertised publicly, as in the local newspaper. This latter process usually moves faster -- and makes an already-stressed homeowner even more vulnerable to a scam, says Renuart.

Do's and don'ts:

• Do call your mortgage company or lender if you're in trouble. Ask for the loss mitigation department. Contrary to popular perception, lenders don't want to steal your house, says attorney Dollar. They want to work with you. Why? "Lenders always lose money on foreclosures, even in a rising market," Dollar says. Scammers, on the other hand, will try to keep you from communicating with your lender.

• Don't call for assistance from one of those ubiquitous signs on telephone poles that advertise help. Chances are, that's not where help lies.

• Do proceed with caution, if a company or person:

o Describes itself as a "mortgage consultant," "foreclosure service," or something similar;

o Collects a fee before giving any services;

o Advertises to people whose homes are listed for foreclosure, including anyone who sends flyers or solicits door-to-door; and

o Says you should make home mortgage payments directly to them or to their company instead of your mortgage lender.

• Don't panic. Get full information on the foreclosure process in your state. Make sure you know ALL deadlines -- for court, for document filings, etc. States usually have associations that can offer free advice. Minnesota, for example, has the Minnesota Housing Finance Agency as well as the Minnesota Mortgage Foreclosure Prevention Association, which has federal Housing and Urban Development counselors available. For who to turn to for advice, click on your state here.

Scam No. 3: The bait-and-switch

In this scam, which NCLC calls the "bait-and-switch," con artists actually trick a homeowner into signing over the deed to a home -- without his knowledge.

How could somebody fall for this?

Attorney Hand gives an example. Hand is dealing with 10 cases involving the same real estate loan broker, Kaseem Mohammadi of Union City, Calif., who has been charged with 13 counts of real estate fraud. One of Mohammadi’s strategies, Hand says, was to visit his alleged victims armed with a load of documents on a clipboard and places marked with Post-It notes indicating where to sign. His victims -- some of whom were elderly, or didn't speak English well -- were usually overwhelmed by the documents and also couldn't exactly see what they were signing thanks to the clipboard. And one of the things Mohammadi allegedly got them to sign was a "grant deed" that passed their home's title to a third party.

You don't have to be old or a non-English speaker to be stymied by the legalese. Attorney Renuart says she has seen shysters get their victims to sign incredibly complicated legal documents that resulted in their property being transferred to entities such as trusts. "These trust agreements, I can't understand them -- and I'm a lawyer."

And if a criminal can't get the signature? Forgery goes a long way in real estate these days, experts say.

Do's and don'ts• Don't sign anything that has any blank spaces. Information could be added later that you didn’t agree to. (Yes, it happens.)

• Never sign a contract under pressure. Always know exactly what you're signing. Take your time to review the paperwork thoroughly -- ideally with a lawyer who only represents your interests.

• Never make a verbal agreement. Get all promises in writing and get full copies.

• Cast a jaundiced eye at deals that sound too good to be true. Lately, some scam artists promise they'll wipe out or pay off your home's debt for you (so-called "debt elimination"). Some flustered homeowners bite. Just remember the free lunch rule: There isn't one.

A final thought: Remember, if you can't fix your finances, selling your house (on the normal market, that is) may not be the end of the world. Sure, you'll be a renter again. But given how much homes around the country have appreciated in the last several years, chances are you've made some money, which you can use to get back on your feet.

Source of tips: National Consumer Law Center; U.S. Department of Justice's U.S. Trustee Program; attorney Rachel Dollar

Mortgage scams are like Baskin-Robbins offerings -- they come in 31 flavors. Here are three top choices of con artists and how to avoid them.

By Christopher Solomon

If owning a home is the great American dream, then swindling people out of their prized possession is one of the great, lucrative American scams. Mortgage fraud is on the rise, thanks to the tremendous value that's locked up in real estate today and to the increasing number of people who are struggling to pay their mortgages.

"It's kind of become the new get-rich-quick scheme out there," says attorney Rachel Dollar, publisher of Mortgage Fraud Blog.

More than 323,000 properties entered some state of foreclosure in the first quarter of 2006, a 72% increase over the same period a year ago, according to RealtyTrac. And things could get worse: Nationwide, more than one in three outstanding mortgages has an adjustable rate and interest rates have been rising. "Nobody really knows what's going to happen," says RealtyTrac's Rick Sharga, vice president of marketing.

But scammers know that people in trouble make easy victims. They're swooping in and offering to "help" beleaguered borrowers -- and ending up with their house keys. Victims sometimes spend years fighting to get their homes back and some never succeed.

Meet Carol and Anthony

Carol and Anthony Calvagno of Deer Park, N.Y., on Long Island are in a hell like this right now. In 2003, the Calvagnos were in trouble. Anthony Calvagno had health troubles and had lost his job. In order to pay their bills, the couple took out a home equity loan on the Cape Cod-style house that had been in the family for three generations. (At the time, the couple had a $125,000 mortgage on a house worth about $290,000 -- a high-equity target.) But even the home equity loan wasn't enough.

That's when Mitchell Sims swooped in, offering to help, says the couple's attorney, Arshad Majid.

Sims told the couple that he would arrange a bailout, and that they should stop making mortgage payments while he worked out the details. When foreclosure notices started showing up, he told the couple to ignore them, saying he'd take care of it.

Nearly eight weeks after Sims had entered their lives, and the day before their foreclosure was scheduled, Sims told the Calvagnos that the arrangement hadn't worked. Instead, he said they'd have to file for bankruptcy and enter a "special program" in which they'd sign over their house's title to one of Sims' employees and another of his business associates, who also happened to be Sims' brother. They'd be allowed to live in their home as tenants, Sims told them, and their rent payments would go toward buying their home back from him, says Majid. "They were put in the position where they didn't have any choice" but to sell their deed, Majid says.

But Sims never made any mortgage payments. He kept the Calvagnos' rent money and about $50,000 of the couple's money that remained after their creditors were paid.

The Calvagnos had fallen victim to a scam known as equity stripping -- just one of the many flavors of mortgage fraud. Their house was sold. Sims and another person have been put in prison for their crimes. The couple has successfully fought eviction -- so far -- but not everyone is so lucky. Here's a quick look at three of the main ways scammers can steal the roof over your head.

Scam No. 1: The bailout, aka 'equity stripping'

As the Calvagnos' case shows, this scam is particularly ingenious -- and humiliating for the victim. In theory, a person or company could help a homeowner keep his house via a process in which the homeowner sells the house very cheaply to them while the homeowner gets his finances in order. The new owner pays the mortgage, and the old homeowner pays to live in the home in the meantime, buying back the home (with interest) in a fixed amount of time. If the financial setbacks are temporary, and the company is above-board, everybody can win: The homeowner keeps the house and the company earns a profit for its role as rescuer.

But "reconveyance," as it's sometimes known, is ripe for abuse.

Attorney Leah Weaver, who focuses on fighting the scams as an Equal Justice Works Fellow at the Legal Aid Society of Minneapolis, explains how scammers work this fraud:

Suppose you've got a $200,000 home, with $100,000 of equity in it. A divorce and medical bills have you facing foreclosure. Suddenly, the phone rings with a bailout proposal.

So you sell your home, for $120,000 -- not much more than what's owed on the mortgage. Why sell for so little? "Because it's never intended to be a true sale," Weaver explains; remember, you don't think you're selling the house permanently, but buying it back in a short period, right?

The new purchaser, meanwhile, takes out a $120,000 loan, wipes out any liens on your property and even gets you a little cash back; and you get a two-year lease with a purchase option at the end.

But soon you realize you're in trouble. Why? Because scammers aren't about to let you get your home back. Often, the lease terms desperate homeowners agree to turn out to be as onerous as their previous mortgage payments that helped get them into trouble. Con artists also manipulate victims when facing crucial deadlines.

"One of my clients was told that payments were going be to under $1,000 a month," Weaver recalls. But the criminals dragged out the process until the foreclosure was imminent and she was backed into a corner. "When she got to the closing … they were like, 'Oh, no, the payments are going to be $1,150.'

"Inevitably," she says, "you're going to default."

And default isn't pretty. The new purchaser evicts you as soon as possible, sells your $200,000 house, pays off the $120,000 loan and pockets about $80,000 -- all for a few months' work, says Weaver. Some people don't even fight back because they don't know they have options -- such as calling a lawyer, says attorney Dollar.

Do's and don'ts:

• Don't fall for promises like "We'll save your credit"; "We'll buy your house 'as is'"; or "We'll get you a new mortgage with low monthly payments."

• Don't sign away ownership of your property (sometimes called a "quit claim deed") to anyone without the advice of lawyer you trust. "When people get behind on their loan payments, they get a bit desperate, but the answer is not putting someone else on your title," says Oakland real-estate attorney James Hand.

• Beware of any home sale contract where you aren't formally released from liability for your mortgage. Also, make sure you know what rights you're giving up and that you agree to giving them up.

Scam No. 2: Phantom help

This scheme is fairly simple: Let's say you're way behind on your home payments and facing foreclosure. An individual or group approaches and offers to help -- then charges you thousands of dollars for various administrative duties like filing forms and phone calls, or else keeps simply promising a big rescue later. You can probably guess what's really going on: The "helper" isn't really doing anything at all to stop your foreclosure despite collecting thousands from you. By the time you figure out you've been hoodwinked, it's often too late to stop the loss of your house.

How did the scammer know to target you, anyway? That's easy: When a lender schedules the home for public auction, the matter becomes public record. In just more than half of the states, a lawsuit must be filed in order to spur a sale. Anyone can check the court documents to find the list of lawsuits, says Elizabeth Renuart, an attorney with the National Consumer Law Center and co-author of a major report last year on mortgage fraud called "Dreams Foreclosed." Soon, a letter or phone call comes like something from a guardian angel -- only it's a vulture.

In the other states (including California and Massachusetts, for example), the process doesn't go through the courts; foreclosure sales simply must be advertised publicly, as in the local newspaper. This latter process usually moves faster -- and makes an already-stressed homeowner even more vulnerable to a scam, says Renuart.

Do's and don'ts:

• Do call your mortgage company or lender if you're in trouble. Ask for the loss mitigation department. Contrary to popular perception, lenders don't want to steal your house, says attorney Dollar. They want to work with you. Why? "Lenders always lose money on foreclosures, even in a rising market," Dollar says. Scammers, on the other hand, will try to keep you from communicating with your lender.

• Don't call for assistance from one of those ubiquitous signs on telephone poles that advertise help. Chances are, that's not where help lies.

• Do proceed with caution, if a company or person:

o Describes itself as a "mortgage consultant," "foreclosure service," or something similar;

o Collects a fee before giving any services;

o Advertises to people whose homes are listed for foreclosure, including anyone who sends flyers or solicits door-to-door; and

o Says you should make home mortgage payments directly to them or to their company instead of your mortgage lender.

• Don't panic. Get full information on the foreclosure process in your state. Make sure you know ALL deadlines -- for court, for document filings, etc. States usually have associations that can offer free advice. Minnesota, for example, has the Minnesota Housing Finance Agency as well as the Minnesota Mortgage Foreclosure Prevention Association, which has federal Housing and Urban Development counselors available. For who to turn to for advice, click on your state here.

Scam No. 3: The bait-and-switch

In this scam, which NCLC calls the "bait-and-switch," con artists actually trick a homeowner into signing over the deed to a home -- without his knowledge.

How could somebody fall for this?

Attorney Hand gives an example. Hand is dealing with 10 cases involving the same real estate loan broker, Kaseem Mohammadi of Union City, Calif., who has been charged with 13 counts of real estate fraud. One of Mohammadi’s strategies, Hand says, was to visit his alleged victims armed with a load of documents on a clipboard and places marked with Post-It notes indicating where to sign. His victims -- some of whom were elderly, or didn't speak English well -- were usually overwhelmed by the documents and also couldn't exactly see what they were signing thanks to the clipboard. And one of the things Mohammadi allegedly got them to sign was a "grant deed" that passed their home's title to a third party.

You don't have to be old or a non-English speaker to be stymied by the legalese. Attorney Renuart says she has seen shysters get their victims to sign incredibly complicated legal documents that resulted in their property being transferred to entities such as trusts. "These trust agreements, I can't understand them -- and I'm a lawyer."

And if a criminal can't get the signature? Forgery goes a long way in real estate these days, experts say.

Do's and don'ts• Don't sign anything that has any blank spaces. Information could be added later that you didn’t agree to. (Yes, it happens.)

• Never sign a contract under pressure. Always know exactly what you're signing. Take your time to review the paperwork thoroughly -- ideally with a lawyer who only represents your interests.

• Never make a verbal agreement. Get all promises in writing and get full copies.

• Cast a jaundiced eye at deals that sound too good to be true. Lately, some scam artists promise they'll wipe out or pay off your home's debt for you (so-called "debt elimination"). Some flustered homeowners bite. Just remember the free lunch rule: There isn't one.

A final thought: Remember, if you can't fix your finances, selling your house (on the normal market, that is) may not be the end of the world. Sure, you'll be a renter again. But given how much homes around the country have appreciated in the last several years, chances are you've made some money, which you can use to get back on your feet.

Source of tips: National Consumer Law Center; U.S. Department of Justice's U.S. Trustee Program; attorney Rachel Dollar

How to Answer These Tricky Interview Questions

How to Answer These Tricky Interview Questions

By Kate Lorenz, CareerBuilder.com

Does the thought of going on a job interview cause your palms to sweat and your body to break out in hives? Stop itching; you're not alone.

The vast majority of job seekers admit to emotions ranging from mild uneasiness to downright panic leading up to their interviews. The good news is there have been no reported cases of job seekers who died of nervousness during a job interview. So relax and follow these simple tips for keeping your anxiety at bay before and during your interview.